Did you know that 82% of global companies are either using or exploring AI in their operations?

AI isn’t just another buzzword—it’s a powerful tool that’s transforming businesses across every industry.

In the financial services sector, this shift is particularly exciting. The AI market in fintech is currently valued at over $44 billion and is projected to reach $50 billion by 2029.

If your business decides to embrace AI in fintech, it will have:

🚀 Smarter products that your customers will love

🚀 Improved security to protect sensitive information

🚀 Better customer support to quickly address issues

In this article, we’ll dive into the various types of AI being used in fintech and explore how real businesses are successfully using these technologies.

What is AI in Fintech?

Financial technology (fintech), by its very definition, was always destined to use artificial intelligence (AI).

Fintech is the adoption of technology to various financial services to help improve traditional systems, such as creating digital wallets to replace cash and using contactless payments instead of manually inserting cards into machines.

As one of the fastest-growing technologies, AI can take fintech a step further by automating tasks and making processes faster and more efficient.

Here’s how AI in fintech improves the examples mentioned:

- Digital wallets can use AI to give you personalised spending tips, catch fraud as it happens, and suggest special deals based on how you shop.

- Contactless payments can use AI to make transactions safer, keep an eye on spending habits, and quickly spot any suspicious activity.

Overall, integrating AI into fintech not only speeds up and simplifies services but also improves security and customer experience.

Types of AI in Financial Services

Right now, artificial intelligence is not a one-size-fits-all solution; instead, it’s built to handle specific tasks in certain areas.

For example, a fraud detection system can recognise transaction patterns, allowing it to spot suspicious activities quickly.

However, that same AI wouldn’t be able to help with other tasks like customer service or giving investment advice.

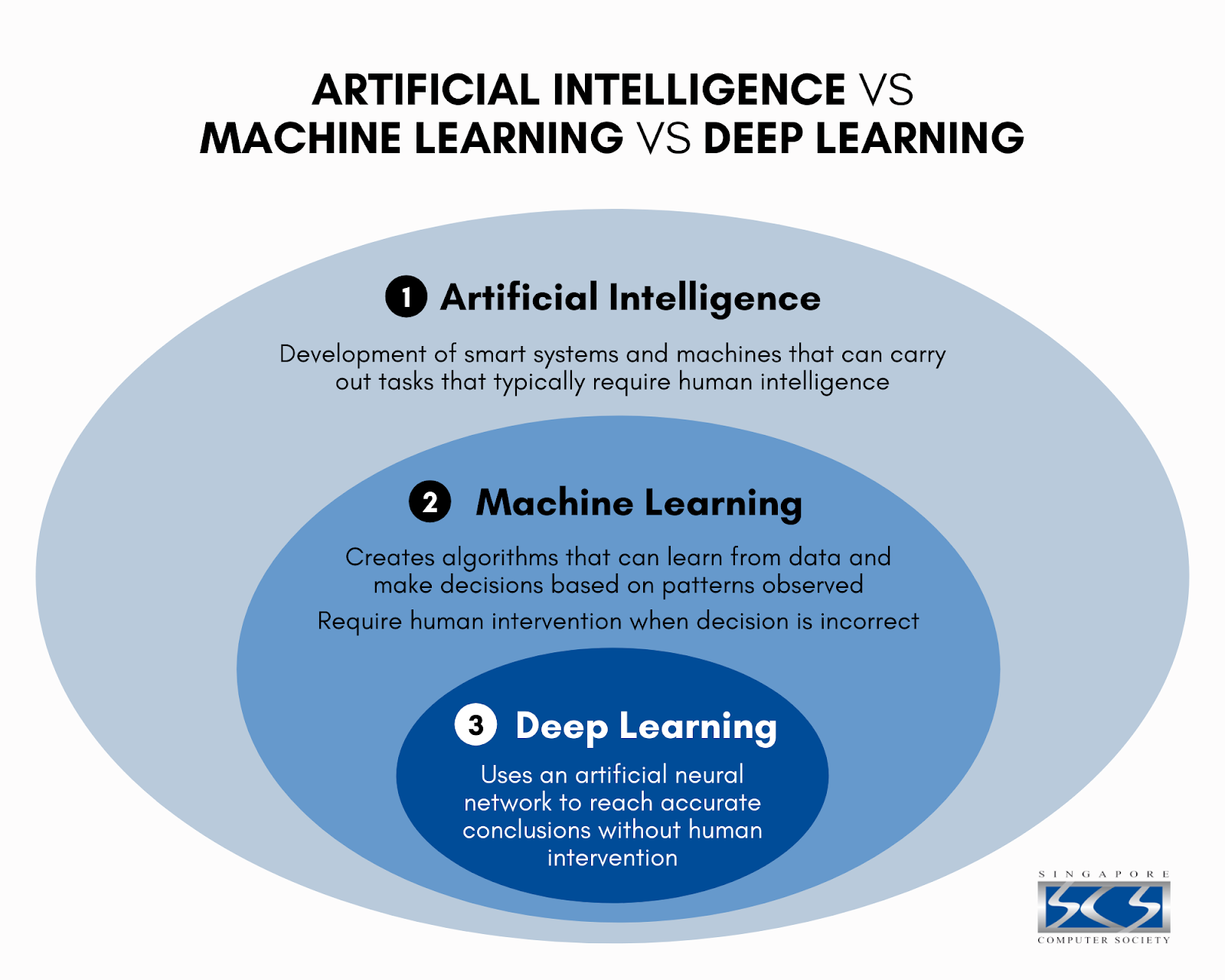

This kind of AI is called narrow AI or weak AI, which is different from strong AI—a concept that only exists in theory for now.

Within narrow AI is machine learning, which focuses on creating computer programs that can learn from data and make predictions based on that information.

A further step is deep learning, which uses layered systems inspired by the human brain to analyse large amounts of data.

Have a look at the below diagram to get an understanding of how they fit into one another:

In fintech, several applications of AI are frequently employed:

💬 Natural language processing (NLP): This helps computers understand and respond to human language, making interactions feel more natural.

🎨 Computer vision: This lets computers recognize and make sense of visual information, like photos and videos. It helps with tasks like verifying identities or scanning documents.

📚 Limited memory: This kind of AI can learn from past experiences. It uses this information to improve decisions and services over time.

🎮 Reinforcement learning: This is when AI learns by trying different actions and seeing what works best. It gets better at tasks through practice and feedback.

🔮 Predictive analytics: This uses AI to look at past data and make educated guesses about what might happen in the future. This helps systems make better decisions.

🚨 Anomaly detection: This is when AI spots things that are out of the ordinary. This is useful for finding mistakes, fraud, or other problems.

🎤 Voice recognition: This allows computers to understand and act on spoken commands, making it easier for users to interact with technology using their voice.

Overall, AI is changing the financial sector by providing targeted solutions that improve operational efficiency, security, and the overall user experience.

AI Trends in Financial Technology

The financial technology industry is filled with products that use artificial intelligence.

Whether it’s for a single feature or the core of their offering, it’s allowing them to take their business idea to the next level.

Here are some ways AI is being used in fintech products today:

1. Getting personalized financial advice with robo-advisors

Having a financial advisor can be incredibly helpful for managing your personal finances.

You can meet one-on-one to get tailored advice on how to save, invest, and handle your money.

However, with the rise of AI, you can now receive financial guidance from robo-advisors.

These AI-powered platforms analyze your financial situation and goals to offer personalized recommendations.

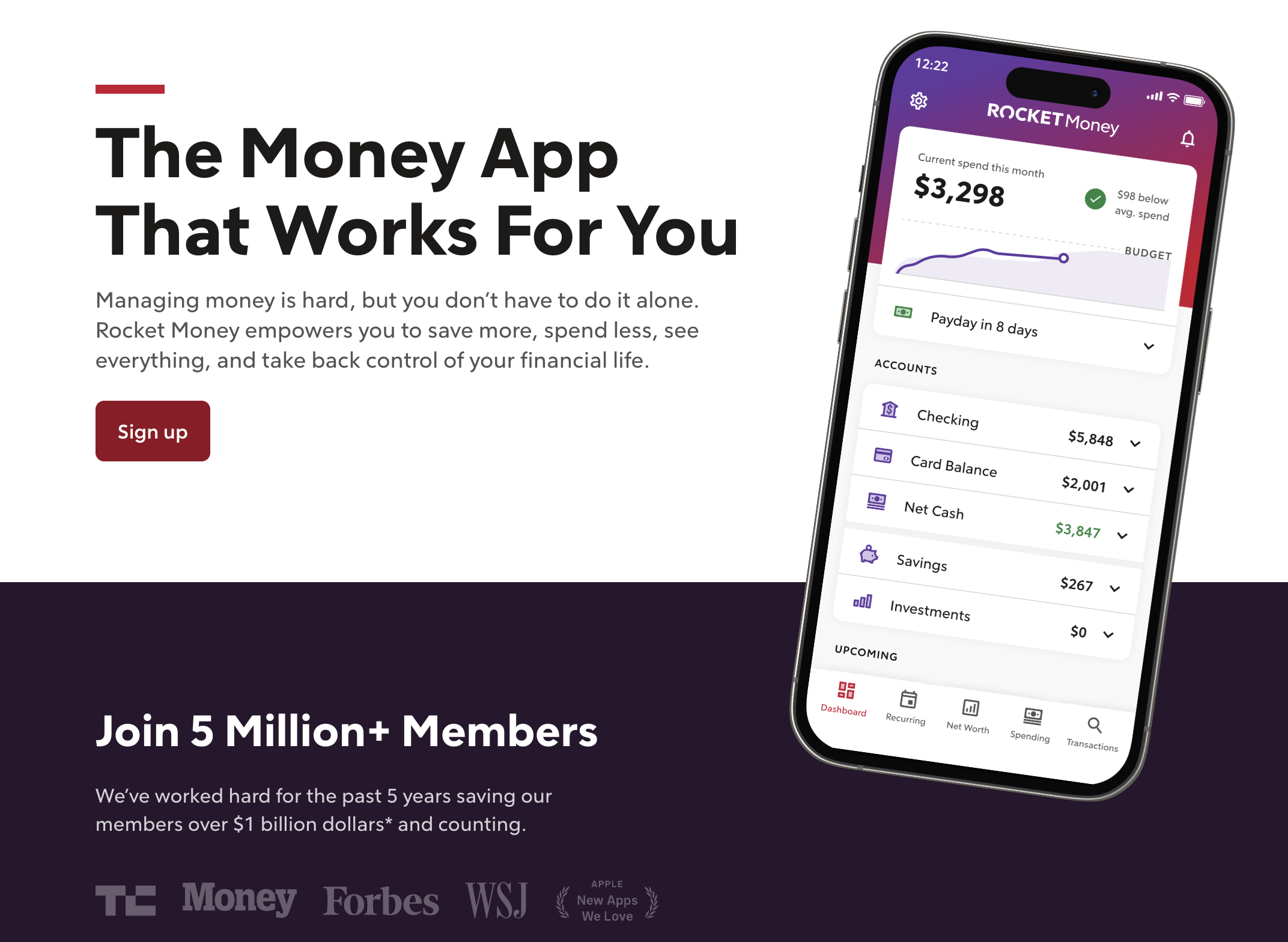

For example, Rocket Money helps users determine which subscriptions are no longer valuable to their lives and then removes them from their monthly billing.

This kind of advice could typically come from a financial advisor, but now it’s provided by AI using algorithms that evaluate your spending habits and preferences.

2. Handling risk management in insurance with AI

Traditionally, insurance companies relied on actuaries who would analyse large datasets and demographic information to estimate the likelihood of claims based on various factors.

This process is often time-consuming and can be limited by the data available at the time, leading to potential inaccuracies.

By using AI, insurers can take advantage of advanced algorithms, analyzing customer data and making more accurate risk assessments.

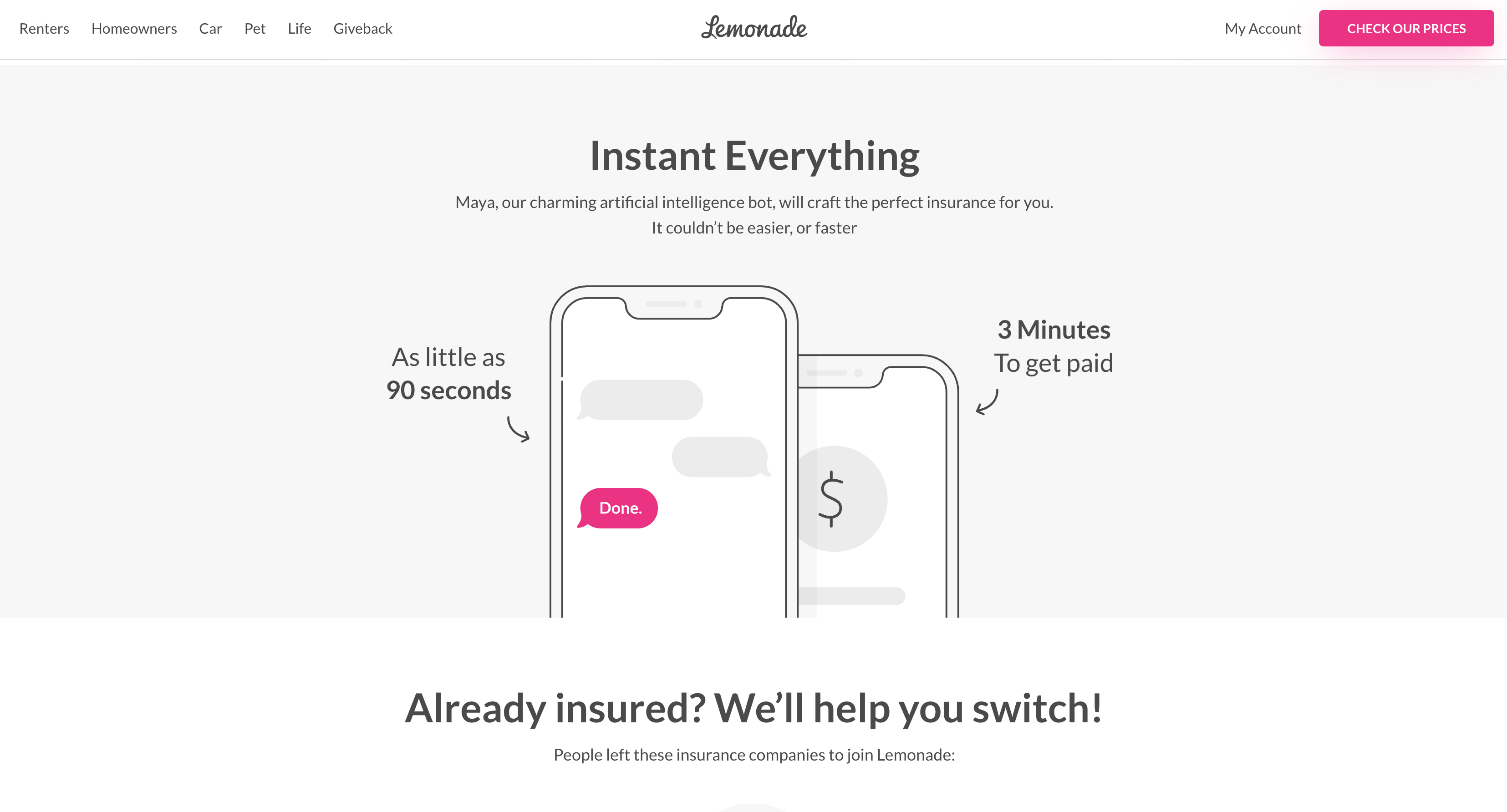

For example, Lemonade uses AI to streamline the underwriting process:

Their chatbot, Maya, interacts with customers to gather information, analyse risk factors, and provide quotes in a matter of minutes.

AI algorithms assess the risk and determine premiums, significantly speeding up the process compared to traditional methods.

3. Improving customer service with AI chatbots

Setting up call centres requires staff, training, documentation, managers, equipment, office space, and legal protection—just in case an operator goes rogue.

An AI-powered chatbot, on the other hand, simply requires an algorithm and access to data.

It can handle a wide range of customer inquiries without human intervention, significantly reducing operational costs and improving your business’s efficiency.

These chatbots can be programmed to provide instant responses to frequently asked questions, assist with policy information, and guide users through claims processes.

Many fintech companies, such as the Bank of America, have set up chatbots that can help their customers resolve issues without the hand of a human being:

They dubbed their bot Erica, which provides customers with financial advice, transaction history, and budgeting tools.

It can also answer queries, help users manage their accounts, and even make payments.

4. AI-powered trading and investing strategies

Choosing the right investment is tricky and, if you get it wrong, you stand to lose a lot of money.

This is why people have traditionally relied on investment firms, which would identify market trends and make recommendations based on their decades of experience.

Unfortunately, getting this advice comes at a premium, making it difficult for many people to understand how they can start investing.

However, with artificial intelligence, investors have access to advanced algorithms that can analyze vast amounts of financial data at lightning speed.

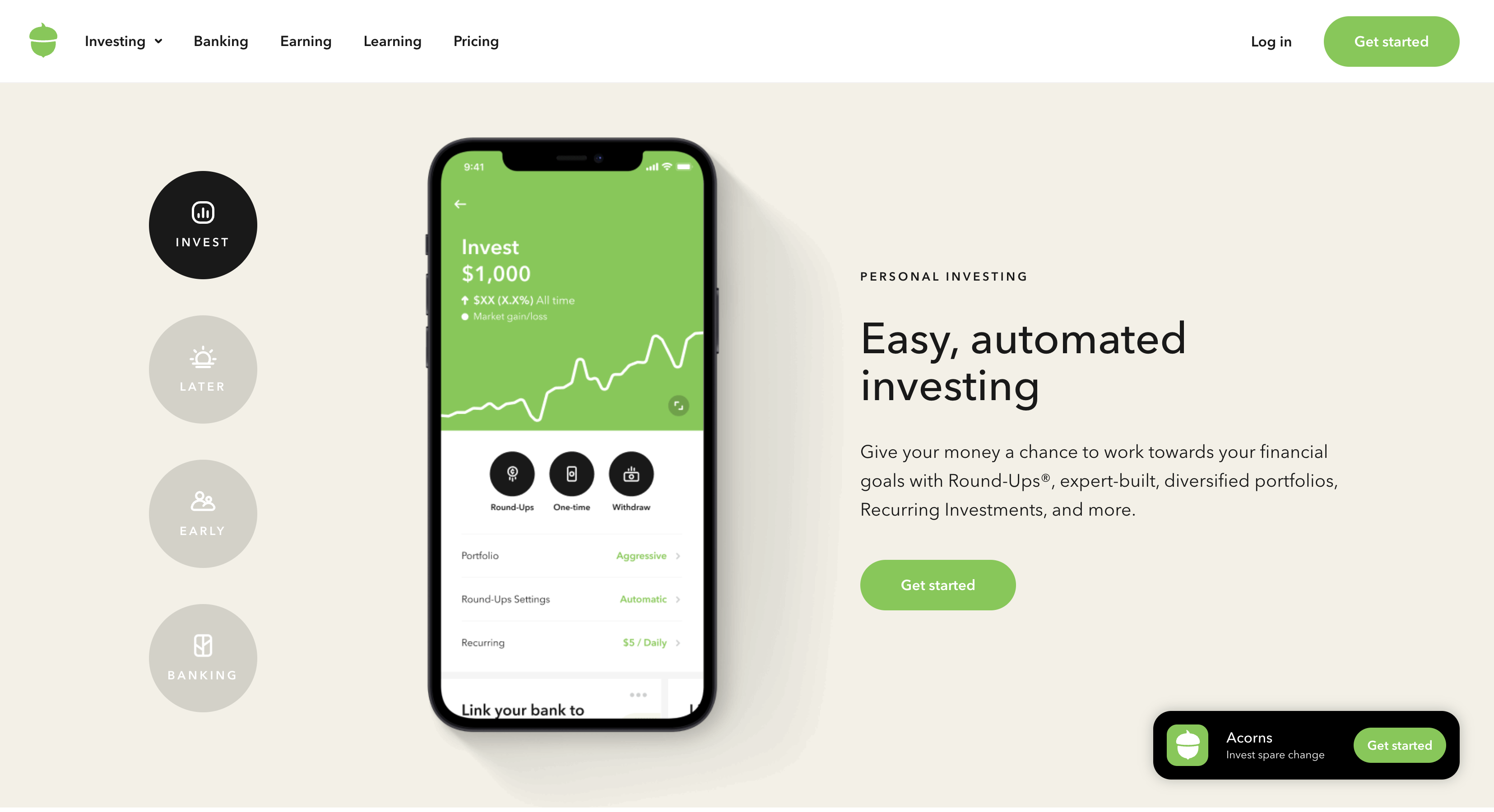

Acorns is a good example of how AI can enhance investment strategies:

It rounds up users’ purchases to invest spare change into diversified portfolios, improving financial inclusion, even those with minimal capital.

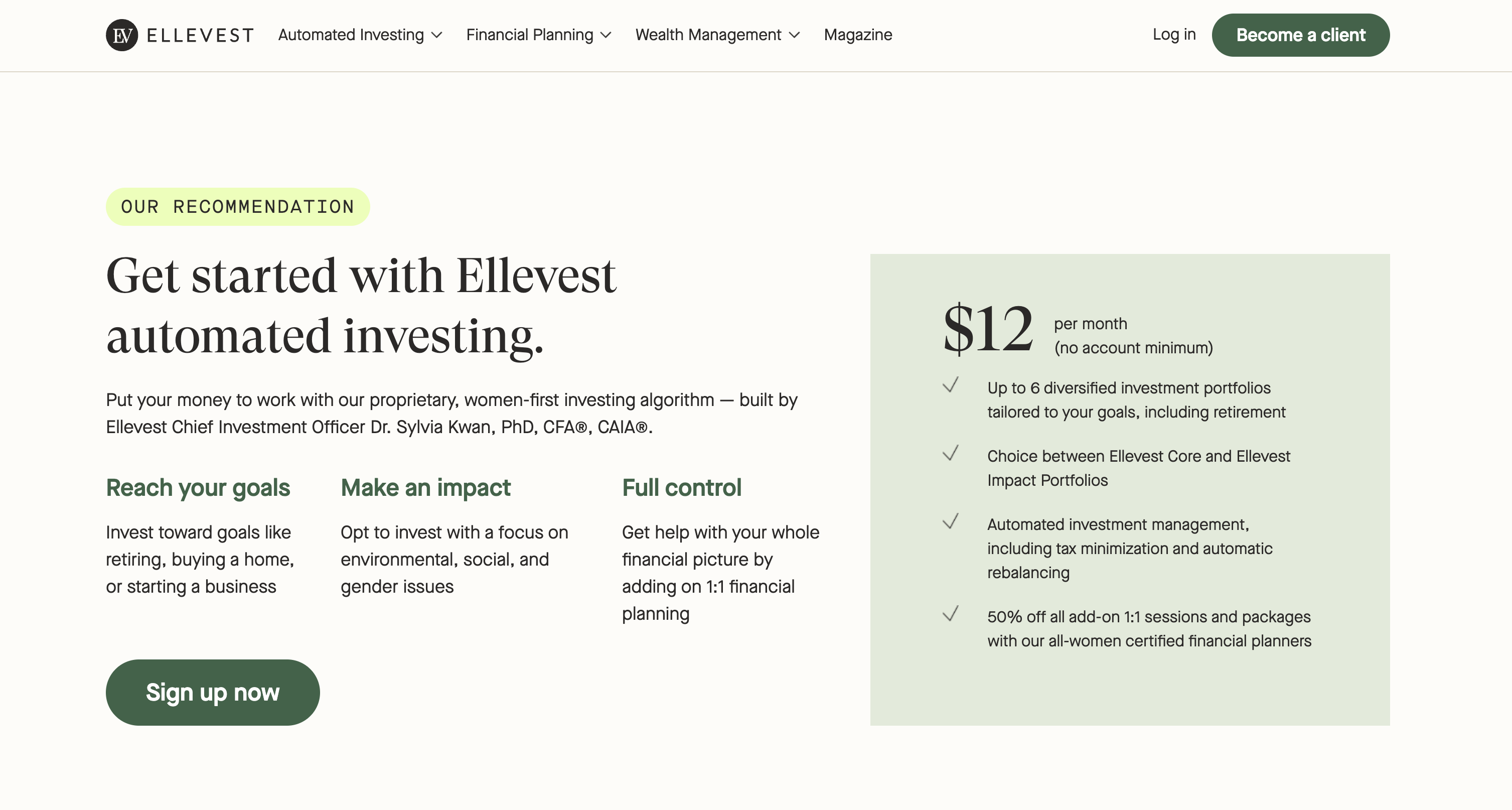

Another great example is Ellevest, which offers AI-driven investment strategies specifically catering to women:

It uses AI to tailor investment portfolio management for various life stages and goals, and provides personalised recommendations based on individual financial situations.

5. Updating credit scores with AI insights

Credit bureaus need to rely on large amounts of data to determine your credit score and make this available to lenders you apply to for credit.

There are several ways in which AI can help improve this process:

- Faster data processing: AI can quickly analyse huge amounts of data, such as your credit history, allowing credit bureaus to update your credit score faster. For example, Experian uses AI to provide instant credit score updates based on new data inputs.

- Predictive insights: AI can identify patterns in your financial behavior and predict how likely you are to repay loans. FICO uses predictive analytics to refine credit scoring models and improve risk assessment for lenders.

Artificial intelligence can also be used by lenders, such as Upstart, to evaluate creditworthiness by looking at a variety of factors beyond traditional credit scores:

For example, they consider educational background, work history, and other personal data to create a more comprehensive profile of potential borrowers.

This allows them to approve loans for borrowers who may have been overlooked.

6. Improving digital banking apps with AI

Digital banks, or neobanks, have popped up across the world since the 2010s, allowing customers to manage their accounts remotely.

At first, these banks primarily focused on offering basic services like checking accounts and payments through easy-to-use mobile apps.

However, as competition grew, digital banks began using AI to differentiate themselves and offer more sophisticated services.

For example, today, it’s used to spot fraud, provide customer support through chatbots, and help users budget better.

One neo bank, Revolut, uses AI in its banking app to confirm the identity of its customers:

They use facial recognition technology as part of their identity verification process when users sign up for an account or perform certain financial transactions.

This helps ensure that only authorised users can access their accounts, improving their overall security.

7. Spotting fraud in financial transactions

Fraud has been mentioned several times so far, but it’s worth highlighting just how important artificial intelligence is in this area.

In the past, fraud detection relied on manual processes and basic rule-based systems, which could be slow and often missed subtle patterns.

Now, AI in fintech uses advanced algorithms and machine learning to detect suspicious activity in a matter of seconds.

AI can analyse vast amounts of transaction data, identify unusual patterns, and flag potential fraud before it causes significant damage.

This is particularly useful for payment gateways, such as:

- PayPal: They keep an eye on financial transactions to spot any fraudulent activity. They look at patterns to find and stop fraud before it happens.

- Stripe: They use fraud detection tools like Stripe Radar, which assesses billions of data points to identify and block potential fraud.

8. Managing compliance for financial institutions

The fintech industry is known for its strict regulations, but this shouldn’t stop you from entering the market (read more about this here).

With the help of AI, you can simplify the compliance process and stay on top of regulatory requirements.

For example, the new bank, Chime, uses AI to automate identity verification and monitor transactions:

This ensures they stay on top of both local and international regulations that govern financial transactions.

How To Use AI For Businesses In the Financial Sector

As you’ve seen from the above examples, there are many different ways in which AI can expand your fintech business.

If you have an app that will help your customers budget better, you could use AI to:

- Give personalised advice: Analyze users’ spending habits to offer custom tips on how to save money based on their needs.

- Predict future spending: Use AI to look at past expenses and guess what users might spend in the future, helping them plan their budgets better.

- Track expenses automatically: Use AI to sort and track spending in real-time, so users don’t have to enter everything manually.

- Set savings goals: Use AI to suggest realistic savings goals based on users’ incomes and spending patterns and help them keep track of their progress.

- Send alerts and reminders: Use AI to notify users about upcoming bills, unusual spending, or ways to save money, keeping them engaged with their finances.

The biggest question you’ll be left with is how you can include AI in your product. This can either be done by building your own AI or buying AI solutions from third-party providers.

Building your own AI lets you customise it exactly how you want, but it requires a lot of time, money, and skilled software developers.

On the other hand, buying AI solutions can be quicker and cheaper. Many companies offer ready-made AI tools that you can easily add to your product.

Have a look at our article that goes into detail about the benefits of building versus buying your own AI.

MOHARA Can Help You Get There

We have helped numerous financial companies incorporate AI into their business ideas.

Our experience in AI integration has helped fintech companies stay competitive, work more efficiently, and grow in the financial industry.

Whether you want to enhance fraud detection, automate customer support, or offer personalised financial advice, we’re here to help you make the most of AI for your business.

Get in touch with us today to find out how we can help you build your business.